Favorite Tips About How To Claim Back Travel Expenses

Our guide is here to clear the fog, providing you with a straightforward path to reclaim your.

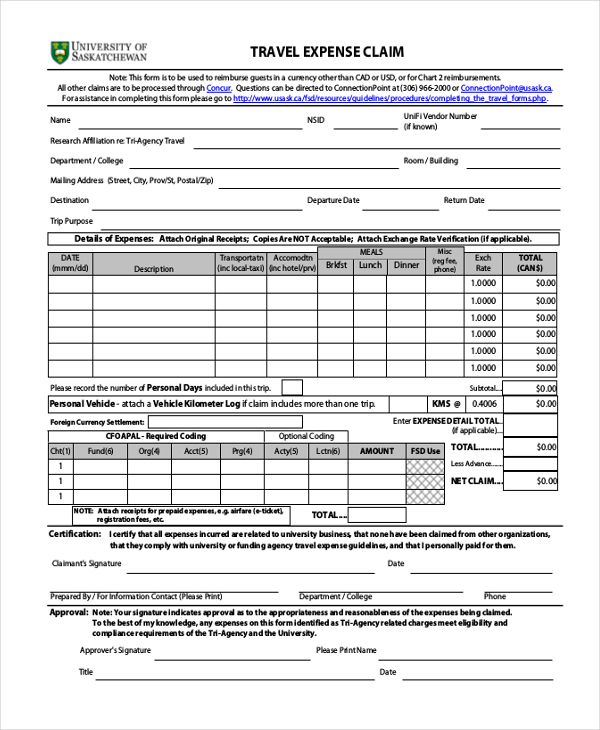

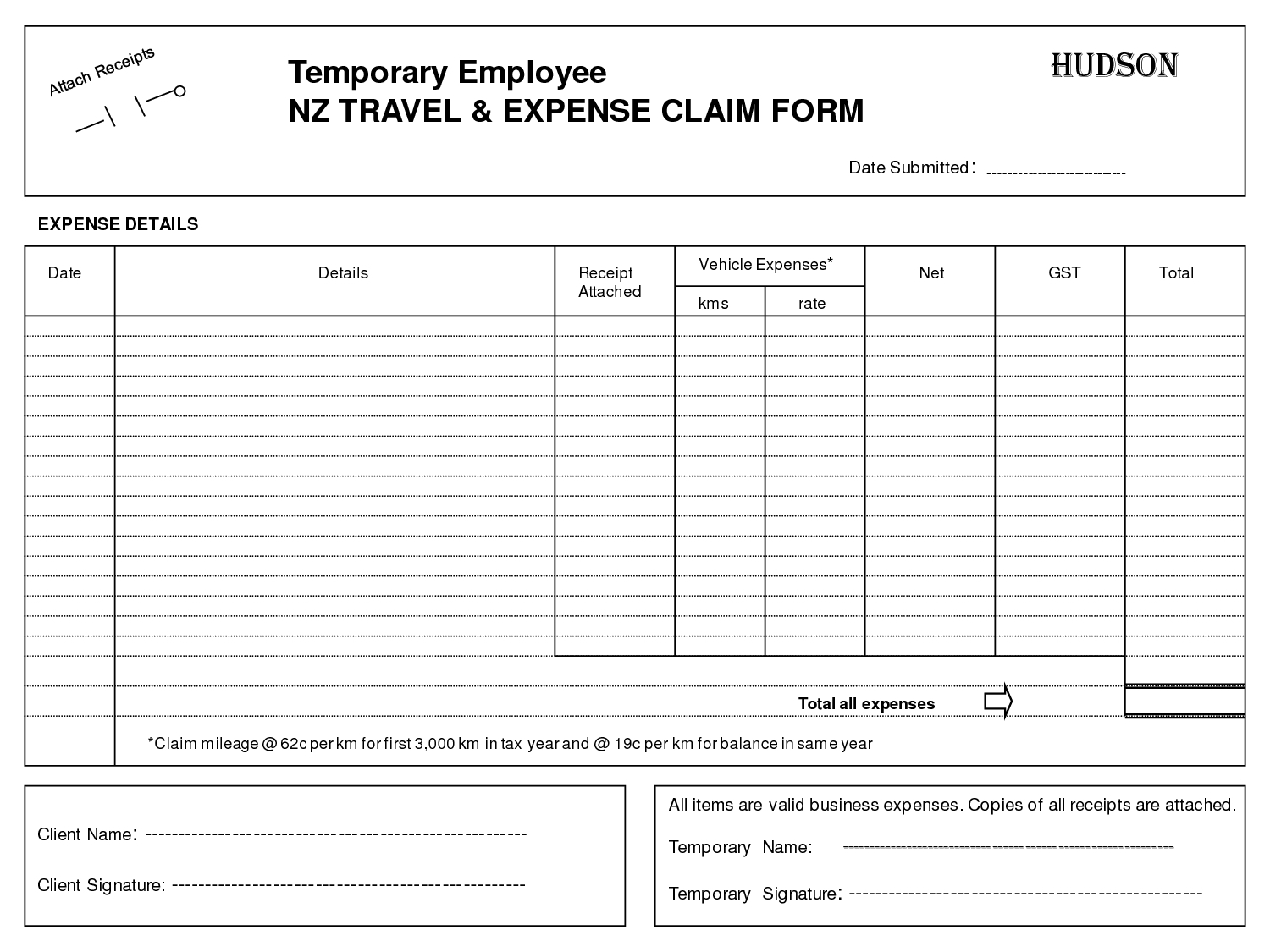

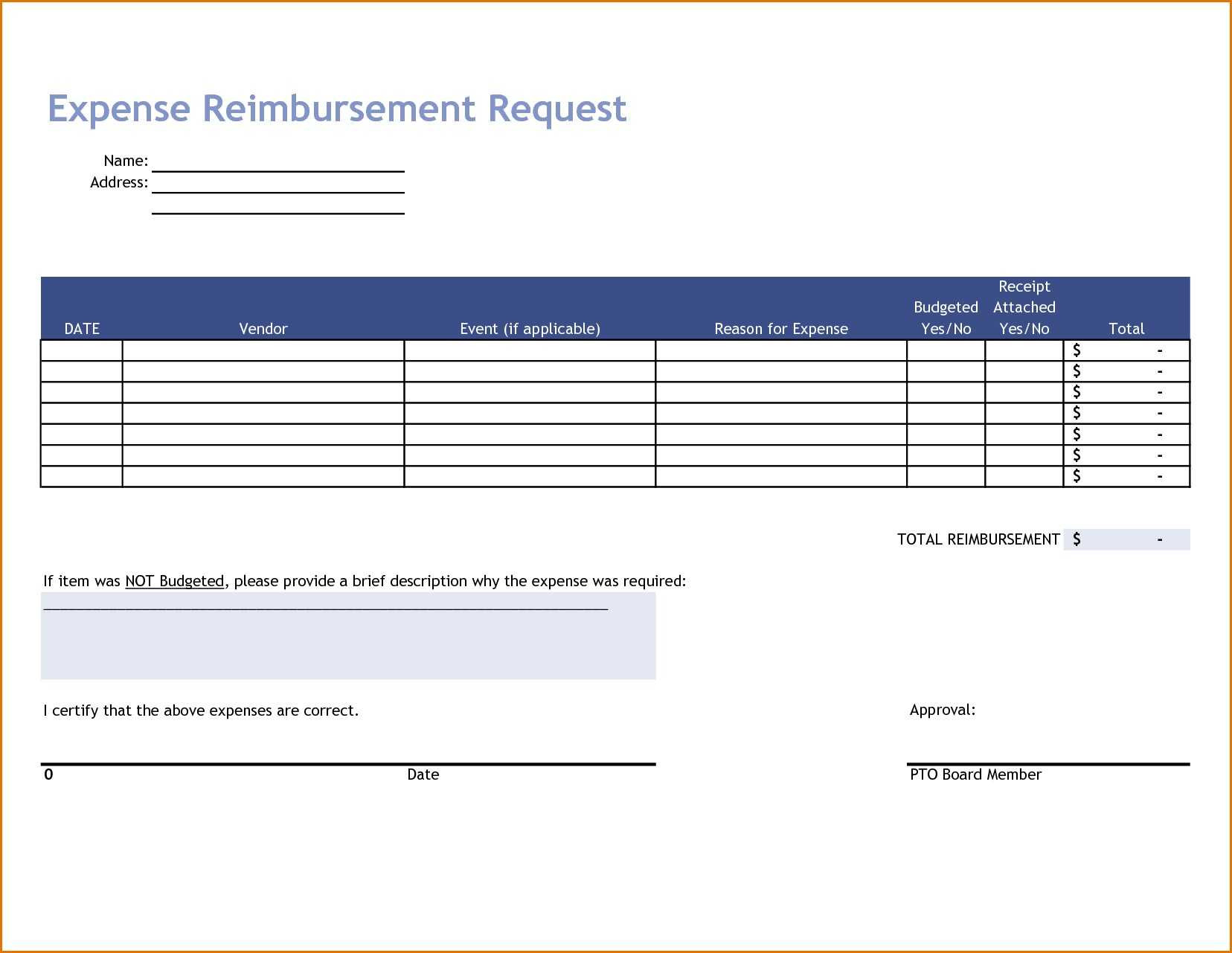

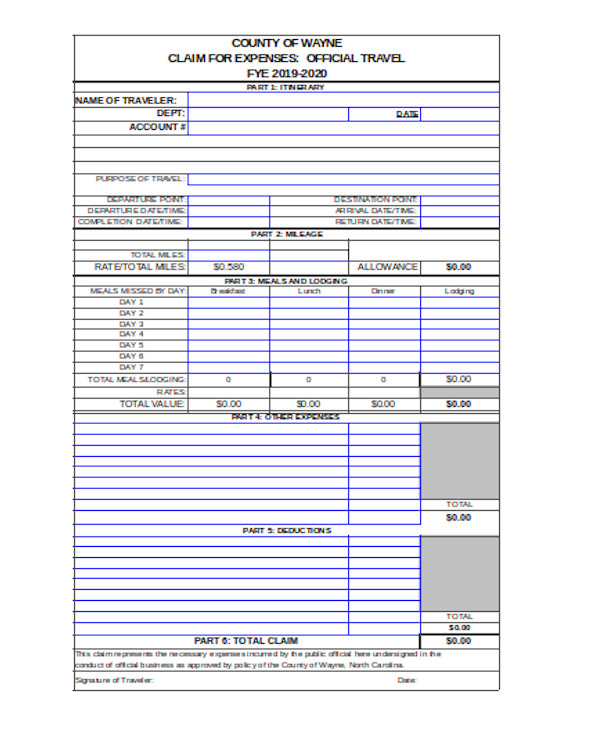

How to claim back travel expenses. What travel expenses can you expect to write off in your next tax return? Businesses must claim travel expenses on form 2106 and. If you're referred to hospital or other nhs premises for specialist nhs treatment or diagnostic tests by a doctor, dentist or another primary care health professional, you may.

Five medical expenses you can deduct on your taxes. Total your transportation and lodging expenses. He pays for everything on his business’s credit card, and keeps receipts.

100% of the cost of his flights. Unsure about what qualifies or how to claim your travel costs back? You cannot claim for travelling to and from work, unless you’re travelling to a temporary place of work.

As the name suggests, travel expenses are. Key takeaways what are travel expenses? You can claim business travel expenses when you're away from home but home doesn't always mean where your family lives.

You can claim back the expense of. This covers many forms of expenses. If you're a member of the national guard or military reserve, you may be able to claim a deduction for unreimbursed travel expenses paid in connection with the.

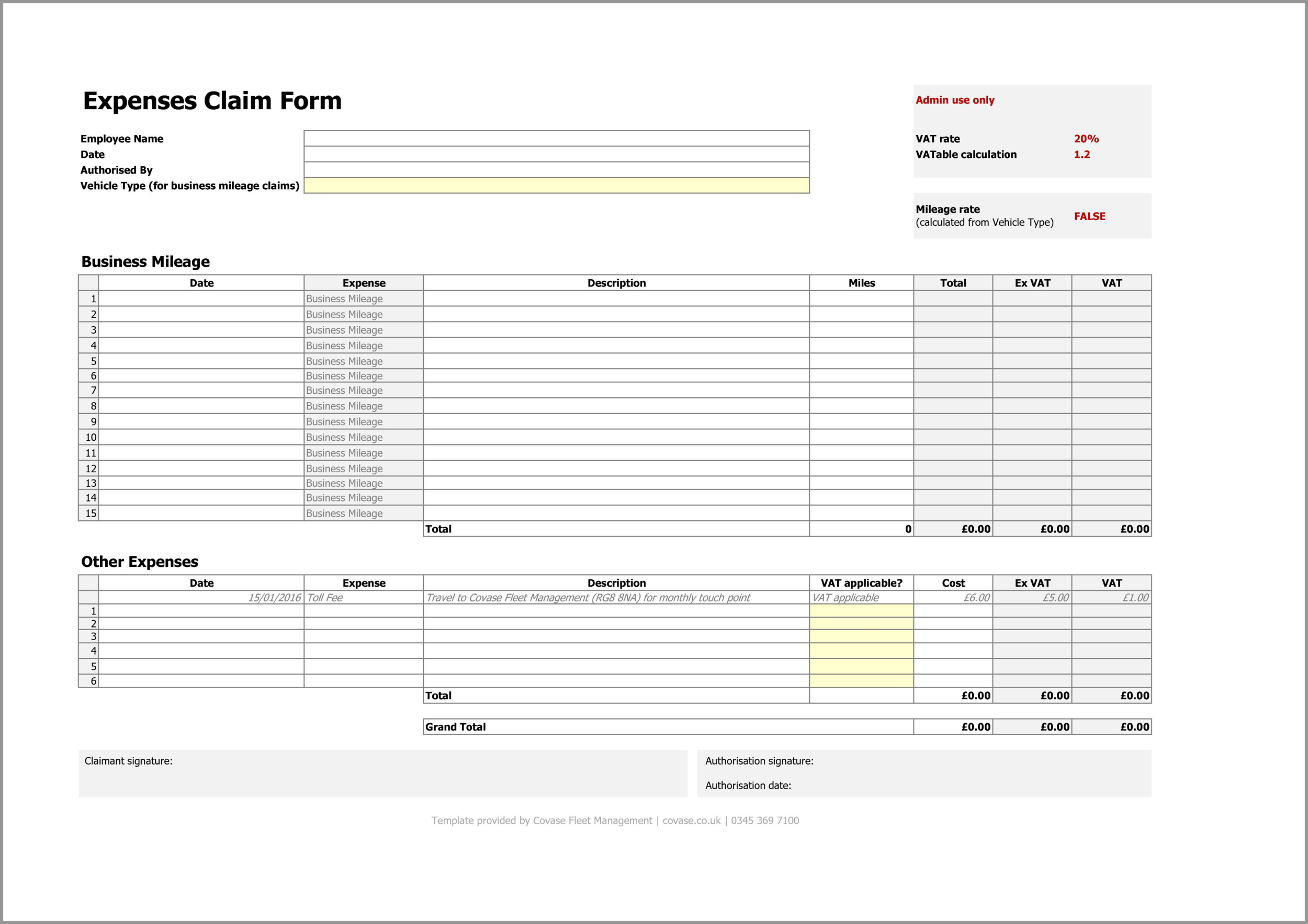

Here’s how to make sure your travel qualifies as a business. Find out how you can claim vat back on your travel costs in this article. Include the allowance as income in your tax return.

You also have a tax home—the city where your. 100% of taxi fares to and from the airport,. Before making a claim for this type of accommodation, check the rules in tr 2021/4 income tax and fringe benefits tax:

How much can i claim? Taxpayers can deduct medical expenses by itemizing them on their taxes. We’ll summarise the essential information you’ll need to successfully make a vat claim.

Print or download on this page expenses you can claim expenses you can't claim how to claim employee travel expenses travel diaries records for business travel expenses. You can claim tax relief for money you’ve spent on things like: Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help.

Can claim a deduction for your travel allowance expenses. How can i claim for travel expenses?