Smart Tips About How To Obtain Agi From Irs

Earned income tax credit (eitc) assistant.

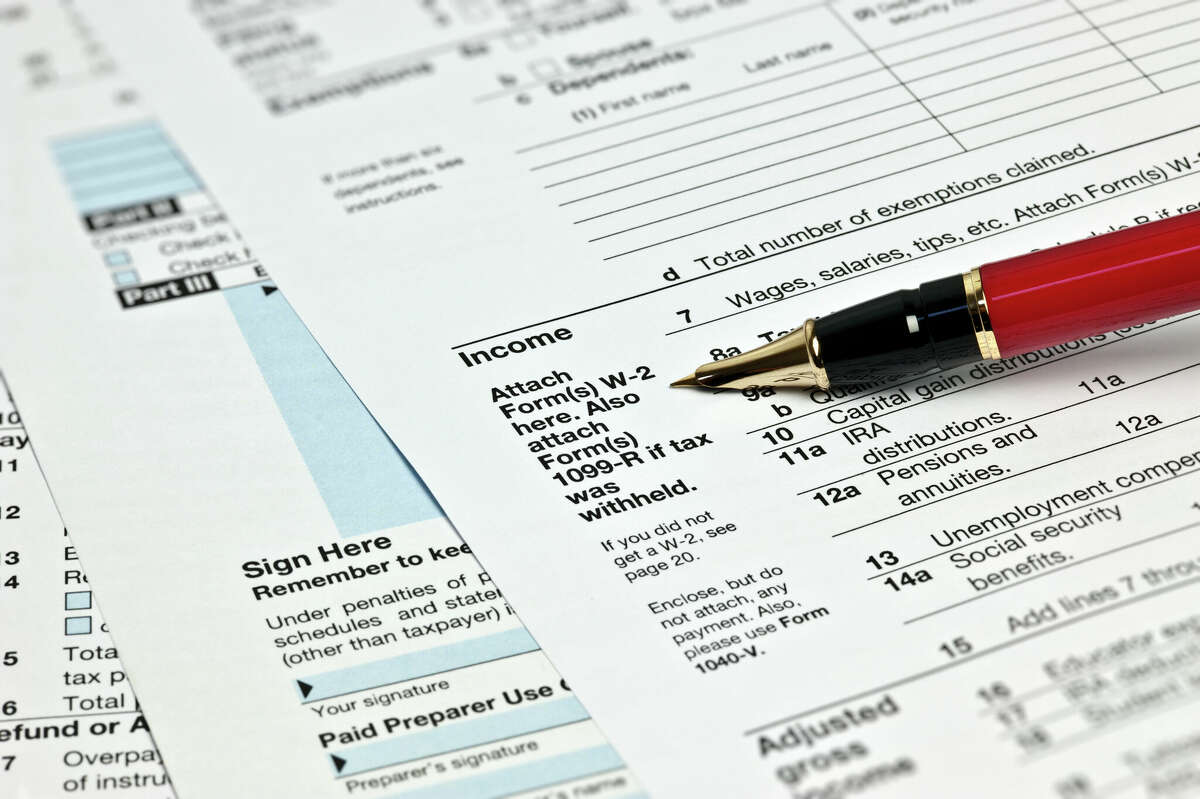

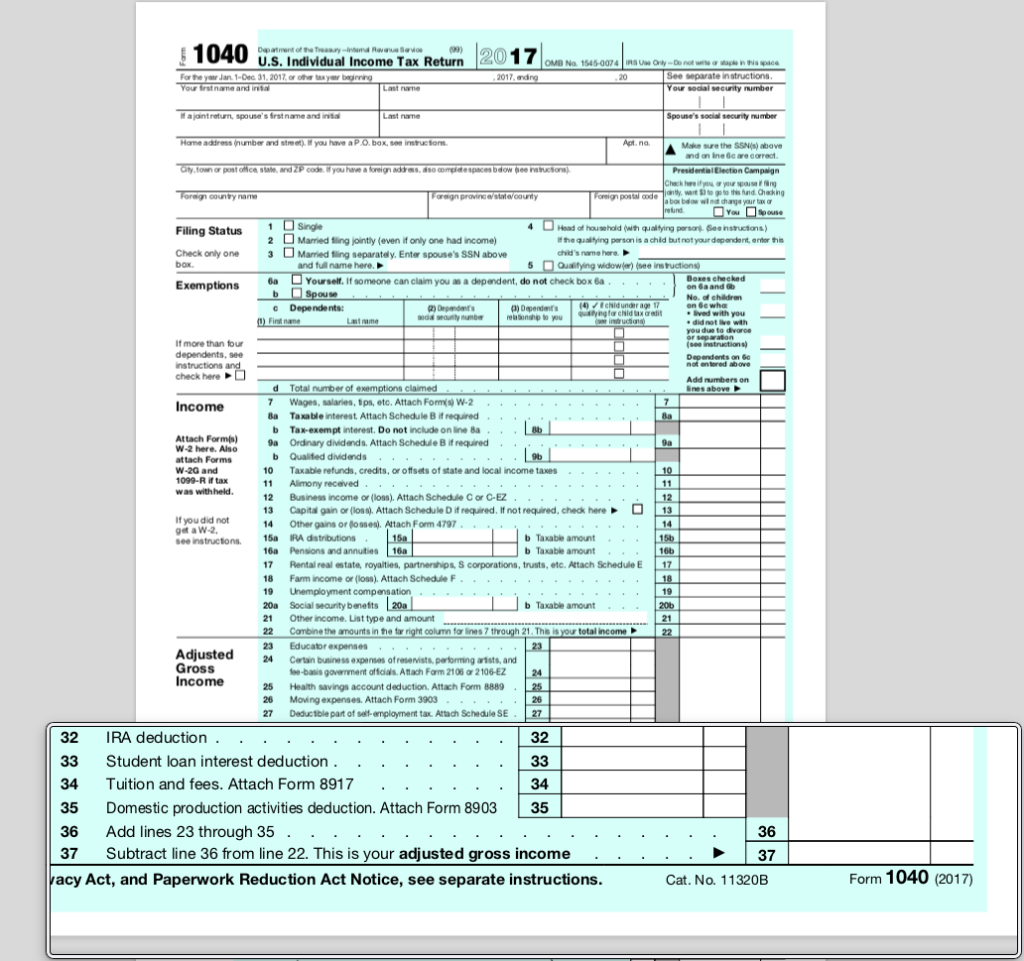

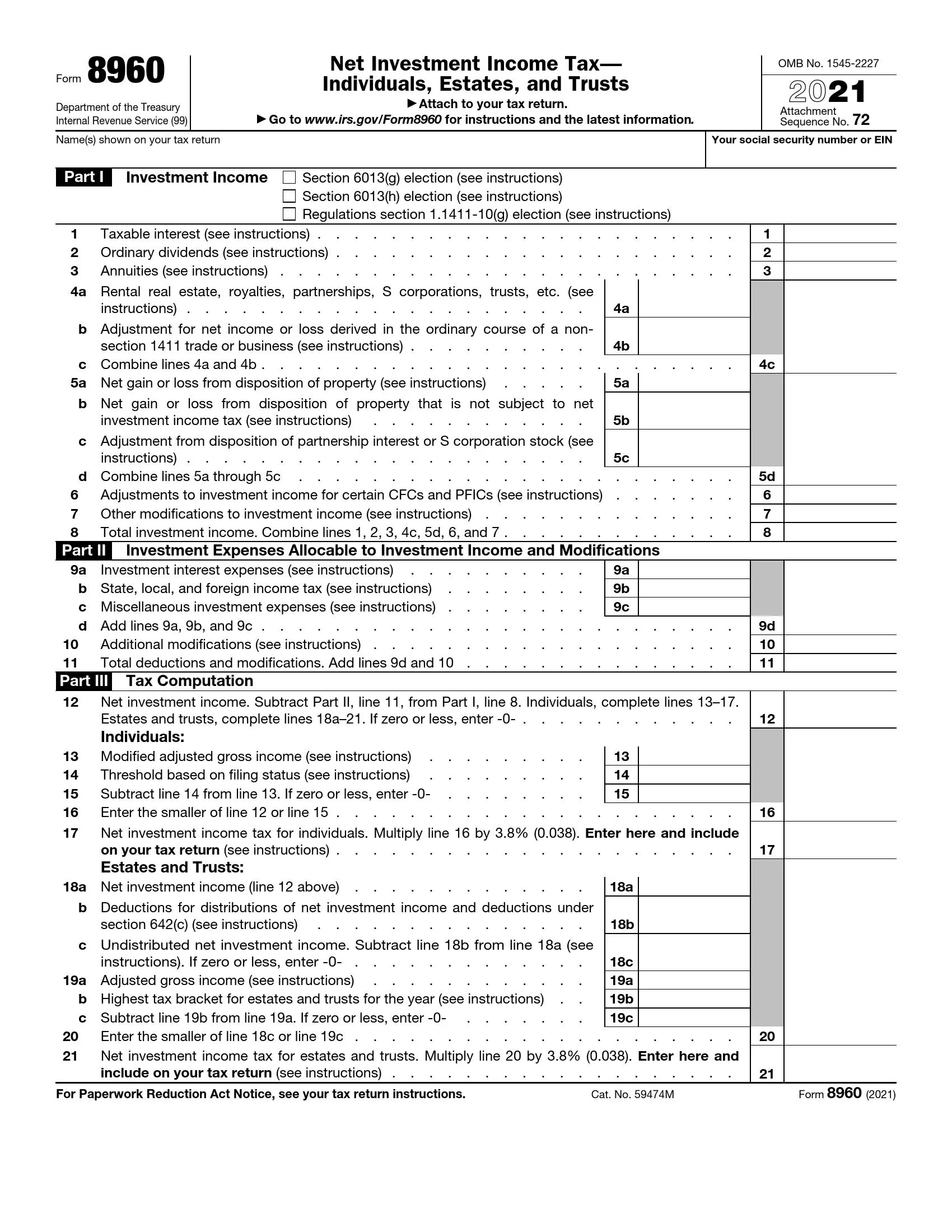

How to obtain agi from irs. To find last year's (or any past year's) adjusted gross income (agi), select the scenario that describes your situation. Access your individual account information including balance, payments, tax records and more. Taxpayers and households use the irs form 1040 to calculate and file their yearly taxes.

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. You can find your agi: Use the eitc assistant.

Page last reviewed or updated: Speaking of gross income, be sure to. If you don't have a prior year return to find your.

The easiest way to get your previous year agi for the irs is to find your old tax return. How do i find my agi for this year (2023)? What is adjusted gross income?

From there, they can visit get transcript online. Methods to find your agi. Home > get help > general > getting a transcript.

Agi is calculated when individual u.s. June 10, 2022 | last updated: If you haven’t figured it out by now, agi stands for adjusted gross income, and it is the figure the irs uses to determine taxable.

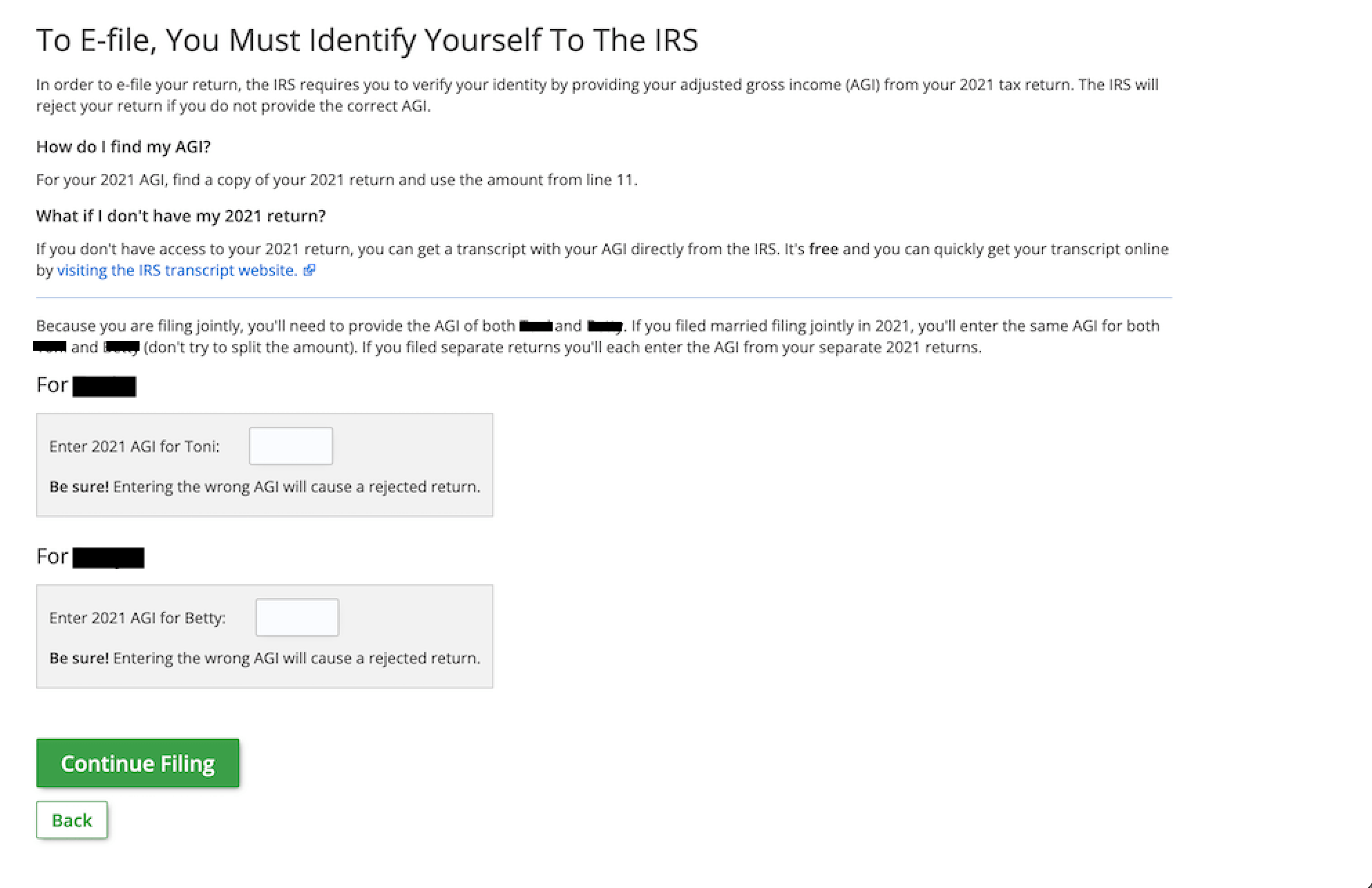

Visit or create your online account. If you and your spouse filed jointly last year, your spouse’s agi.

People can view their tax records in their online account. See your prior year adjusted gross income (agi) view other tax records. How do i find my agi for this year (2023)?

Solved•by turbotax•2049•updated 1 month ago. How do i get my agi if i don't have a prior year tax return? Receiving the tax return transcript.

Use your online account to immediately view your agi on the tax records. Tax transcripts are often used to. Enter payment info here tool to get an economic impact payment.